OPEC+ was right, again

November 2025 Oil Commodities Outlook

Brent crude and West Texas Intermediate, industry benchmarks, started November in a pronounced downturn—holding above $62 and $58 per barrel, respectively, after days of steep losses. The driver: OPEC’s latest forecast, coupled with the International Energy Agency’s sixth consecutive upward revision to global surplus predictions. Reports now estimate a record surplus of more than 4 million barrels per day for 2026, sending floating storage rates soaring and exposing the market’s struggle to absorb excess barrels.

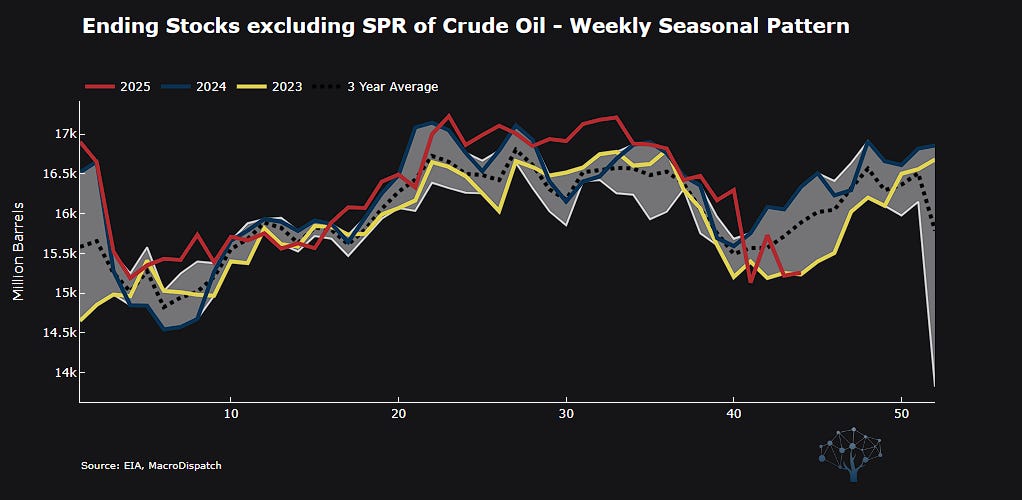

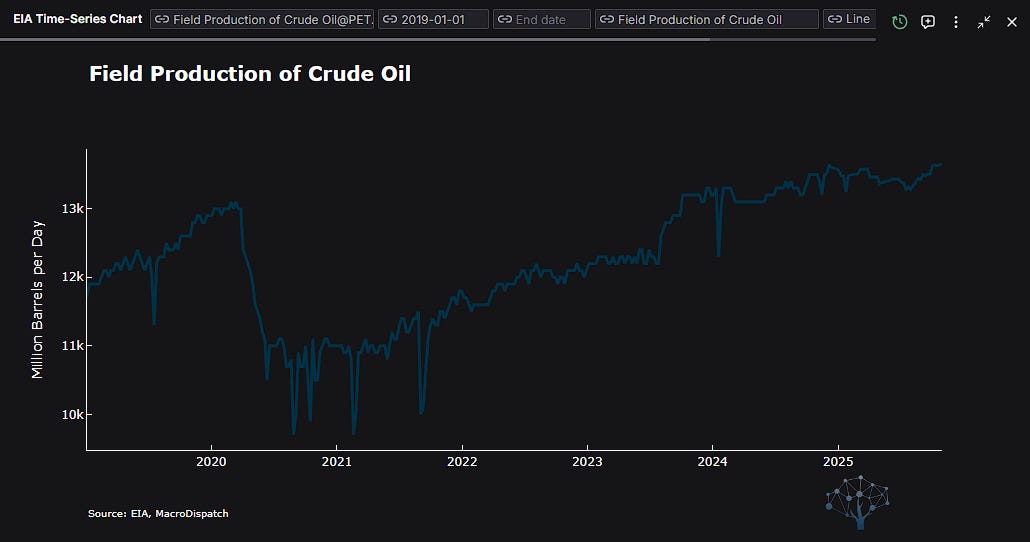

Recent months saw OPEC+ nations, led by Saudi Arabia and UAE, ramp up output to reclaim market share. Meanwhile, non-OPEC growth continued, swelling inventories heading into winter. The result: orderly, yet heavy markets—rangebound around $60 to $70, but increasingly vulnerable if weather patterns weaken demand or if refinery margins collapse further.bloomberg+1

At the heart of this surplus lies weaker demand signals from the U.S. Inventories have climbed, with refineries running at lower output due to both seasonal weakness and fading consumer appetite. While U.S. players respond cautiously, Asia’s refiners scramble for competitive pricing, balancing aggressive procurement against regulatory mandates and fluctuating foreign exchange rates.wsj+1

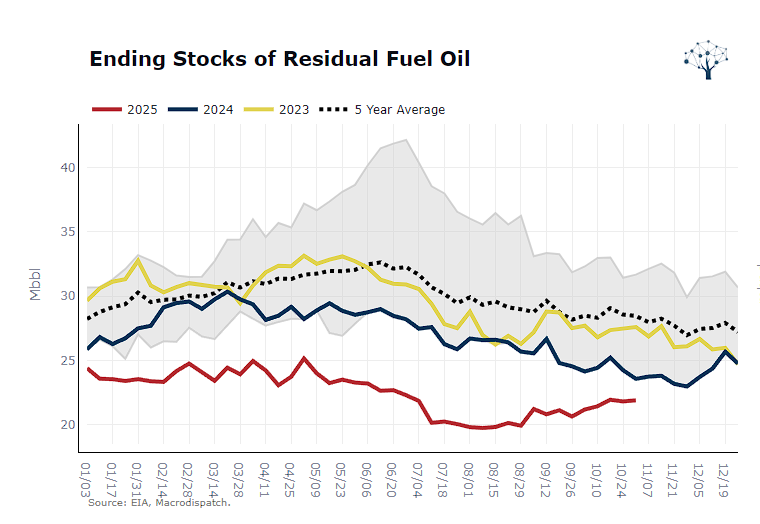

Chinese and Indian importers are leveraging the surplus to build national reserves, but the spectre of future volatility—whether from sanctions, port shutdowns, or supply chain disruptions—encourages hedging through both physical contracts and derivatives. In Japan, marine fuel requirements have also tightened, leading to more complex compliance overlays amid the shifting regulatory landscape.

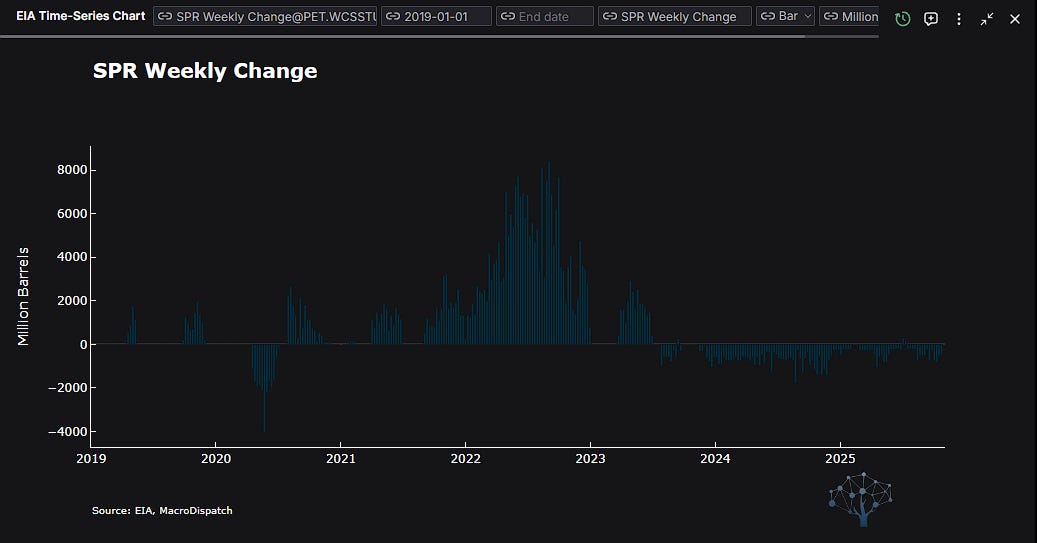

OPEC’s strategy has whipsawed between supply discipline and market defense. The November update saw group-wide output projections climb, and a sudden shift from anticipated deficit to excess. Saudi Arabia, long the anchor of spare capacity, now finds its buffer whittled away as production rises. The UAE similarly pushes boundaries, increasing the risk that any new crisis—a hurricane, cyberattack, or escalation in embargo—could provoke sharper swings than the market presently expects.

For traders, the OPEC meeting schedule is now a key risk factor. Algo-driven market participants monitor developments in Vienna as closely as any macroeconomic indicator, with the latest policy nuance capable of triggering instant moves in crude futures and options.

Oil futures and options volumes have exploded over the last year. Volatility, once a symptom of disruption, is now a feature—the pulse by which market participants price risk and opportunity.

This autumn saw a fundamental shift in spread trading: backwardation now dominates the forward curve, signaling acute near-term scarcity even as overall supply appears ample. Options desks are running ‘gamma-neutral’ strategies to buffer against shock announcements and surprise drawdowns.

If you want to read more about the state of the futures curve link below :

When the Curve Flattens

The oil market is flashing a warning the world hasn’t seen in years. In 2025, the familiar drumbeat of geopolitical risk and OPEC headlines has lost its power to hold prices buoyant. Futures contracts—the core instruments oil traders use to bet on tomorrow—now tell a radically different story: the era of healthy backwardation is ending, and contango is on the horizon. This is a sea change not just for energy markets, but for anyone investing in or depending on the global economy.

For many institutions, oil now serves as both a hedge against broader inflationary risk and a direct proxy for geopolitical volatility. Banks and hedge funds rebalance portfolios daily, overlaying traditional positions with real-time sentiment analysis and event-driven plays.

Regulatory Overhaul and Carbon Mandates

Regulation is flexing its muscles in 2025. The EU’s new FuelEU Maritime rules and RED III mandate have drastically rewritten the playbook for shippers, refiners, and traders operating in Europe. Bunker hedging strategies increasingly require carbon offsets; compliance tokens trade at record premiums as market participants forecast tighter enforcement across northern ports.

Elsewhere, Asian and Middle Eastern policy bodies have responded by streamlining compliance and investing in blended fuels, while U.S. regulators adjust tax rates in response to both recessionary pressure and climate imperatives. In effect, regulatory risk is now priced almost instantly into derivatives and procurement contracts.

Analysts expect further reforms—potentially targeting carbon intensity and traceability—when the new policy cycle begins in Q1 2026. Market sentiment hinges on the pace and clarity of these changes. The age of algorithmic trading in oil is here. Sentiment engines parse everything from OPEC press releases to weather bulletins; natural-language processing models attempt to forecast regulatory action based on political statements and commodity blogs.

Desk traders report that headline risk—once the concern of macro strategists—is now baked into daily volatility modelling. Flash crashes and sub-second spikes are no longer rare; they represent the speed at which news, both real and manufactured, is integrated into global price discovery.

A key lesson of 2025: quantitative strategy must be paired with expert judgment. If data clouds over a refinery fire or misreads a sanctions announcement, model-driven trading can exacerbate moves, creating opportunities and risks in equal measure.

European refiners remain under pressure from both surplus-driven price declines and increasingly complex regulatory demands. Storage tanks across the Netherlands and Belgium are full, with floating storage rates near historic highs. Traders in Rotterdam describe the market as “thick but nervous,” with every government announcement and weather anomaly prompting instant recalibration.

Shipping executives are torn between short-term RMG 380 purchases and longer-term VLSFO swaps, each complicated by carbon obligations. New EU directives are forcing recalculation of both blend ratios and compliance strategies, leaving decision-makers seeking clarity in a noisy news environment.

Middle East—Growth and Geopolitical Calculus

Saudi Arabia and the UAE have used 2025 to press their advantage, boosting production to mitigate fiscal strains while carefully monitoring spare capacity. At the same time, flows from sanctioned producers—Russia, Iran, Venezuela—remain wildcards. Any breakdown in enforcement could release millions of marginal barrels, driving price moves far sharper than the current orderly range might suggest.

Regional leadership has responded with investment pledges for upstream projects, though fiscal realities temper optimism. The consensus: today’s surplus masks future risk, and disciplined investment remains crucial.

China, India, and Southeast Asia continue aggressive buying even as refining margins weaken. Their goal: bolster national reserves while leveraging favourable prices for domestic producers. The region’s policy response is less about compliance and more about resource control and strategic advantage—a strategy likely to intensify if supply disruptions accelerate.

Japan’s compliance regime for marine fuels leads to mix-and-match procurement, blending traditional bunkers with renewable components. The hope is to future-proof operations against ever-tightening EU and U.S. mandates.

“Today’s surplus is tomorrow’s shortage if investment doesn’t keep up,” says one portfolio manager at a leading commodity fund. OPEC’s “rendezvous with reality”—a phrase borrowed from the IEA’s latest World Energy Outlook update—reminds traders that fossil fuel demand may rise until 2050, upending earlier transition narratives.

Oil majors funnel profits into shareholder returns, resisting the lure of new exploration until price signals turn more robust. The risk: failing to bridge a projected 20–25 million barrel per day supply gap by the early 2030s. If current depletion rates persist, the world could face a dramatic squeeze, turning 2025’s comfort into 2030’s crisis.

Hedging, Speculation, and Market Sentiment

Airlines and shippers hedge jet and bunker costs against regulatory uncertainty and supply shocks. Commodity desks run intricate options portfolios—gamma hedges, calendar spreads, volatility arbitrage—all engineered for both sudden collapses and dramatic rallies. Sentiment is a critical variable. Desk heads report that major moves in crude are triggered not just by physical draws, but by exogenous shocks—cyberattacks, embargo threats, or even AI-generated market rumours.

Floating storage remains a focal point. Surplus barrels find homes on tankers off Rotterdam, Singapore, and Houston, awaiting arbitrage opportunities or seasonal demand. Shipping contracts increasingly blend physical product with derivatives overlays, securing both price stability and compliance resilience.

While the near-term setup points to softness, experts warn against underestimating the structural tightness rebuilding beneath the surface. As inventories normalize and surplus barrels clear, markets could reprice the true cost of supply. Unless investment accelerates, prices may rally sharply—an echo of past cycles where surplus bred future scarcity.

Industry leaders expect more downside volatility if winter proves mild or if refinery margins soften. But resilience and flexibility—backed by robust compliance, data-driven trading, and global procurement reach—remain the defining strengths of market winners.