The Helium Gambit

How China Broke America’s Stranglehold and Freed Itself to Play the Rare Earth Card

Why China waited until now to weaponize rare earths reveals a masterclass in strategic commodity planning

The question has puzzled geopolitical observers for years: why did China wait until late 2024 to deploy rare earth export controls as leverage against the United States? After all, Beijing had endured multiple rounds of trade hostilities under the first Trump administration and aggressive semiconductor export controls under Biden. The answer, it turns out, lies not in the rare earths themselves, but in an unexpected dependency that kept China’s hands tied: helium.

Hidden Strategic Vulnerability

Until 2022, China imported 95% of its helium requirements, with the United States controlling most of that supply chain. This wasn’t simply about market dynamics—it represented a calculated strategic constraint. Four of the world’s ten largest helium producers were American companies, while the remaining six relied entirely on American technology for extraction and purification processes.

Helium’s strategic importance extends far beyond party balloons. The noble gas serves critical functions across high-tech industries: quantum computing systems require helium cooling, semiconductor fabrication depends on helium atmospheres, MRI machines need liquid helium for superconducting magnets, and advanced rocket technology relies on helium pressurization systems. For a nation pursuing technological sovereignty, helium dependency represented an Achilles’ heel.

The Strategic Calculus

The logic was brutally simple: if China deployed rare earth export controls, the United States possessed an even more devastating counter-weapon. A helium embargo would cripple China’s advanced manufacturing sectors, quantum research programs, and medical infrastructure simultaneously. This created what strategists call “mutual assured economic destruction”—but with asymmetric vulnerabilities favoring American leverage.

This reality was starkly acknowledged in a November 2022 research paper published in Frontiers in Environmental Science by researchers from PetroChina’s Beijing-based Research Institute of Petroleum Exploration and Development. The authors warned that China would be “greatly affected if the US imposed a ‘stranglehold’ blockade on helium exports”. The paper served as both academic analysis and policy alarm bell, highlighting helium as a critical national security vulnerability requiring immediate attention.

Global Helium Market Dynamics

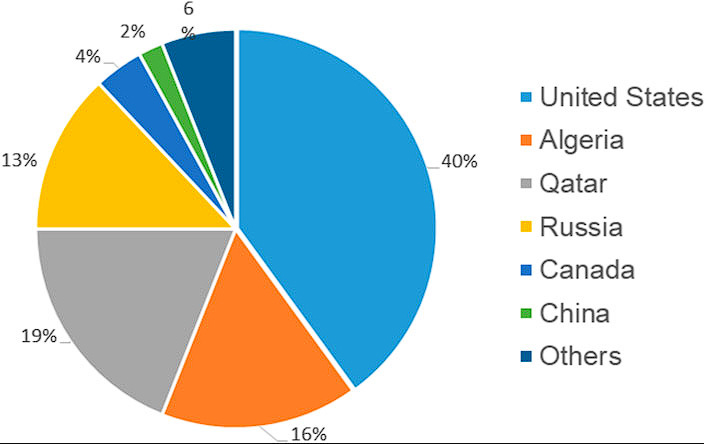

Understanding China’s helium dependency requires examining the global market structure. According to 2020 United States Geological Survey data, global helium resources totaled approximately 51.9 billion cubic meters, with extreme geographic concentration. The United States controlled 20.6 billion cubic meters (40% of global reserves), followed by Qatar (10.1 billion cubic meters), Algeria (8.2 billion cubic meters), and Russia (6.8 billion cubic meters).