When the Curve Flattens

Why Oil, Labor, and Wall Street Are sending the same signal

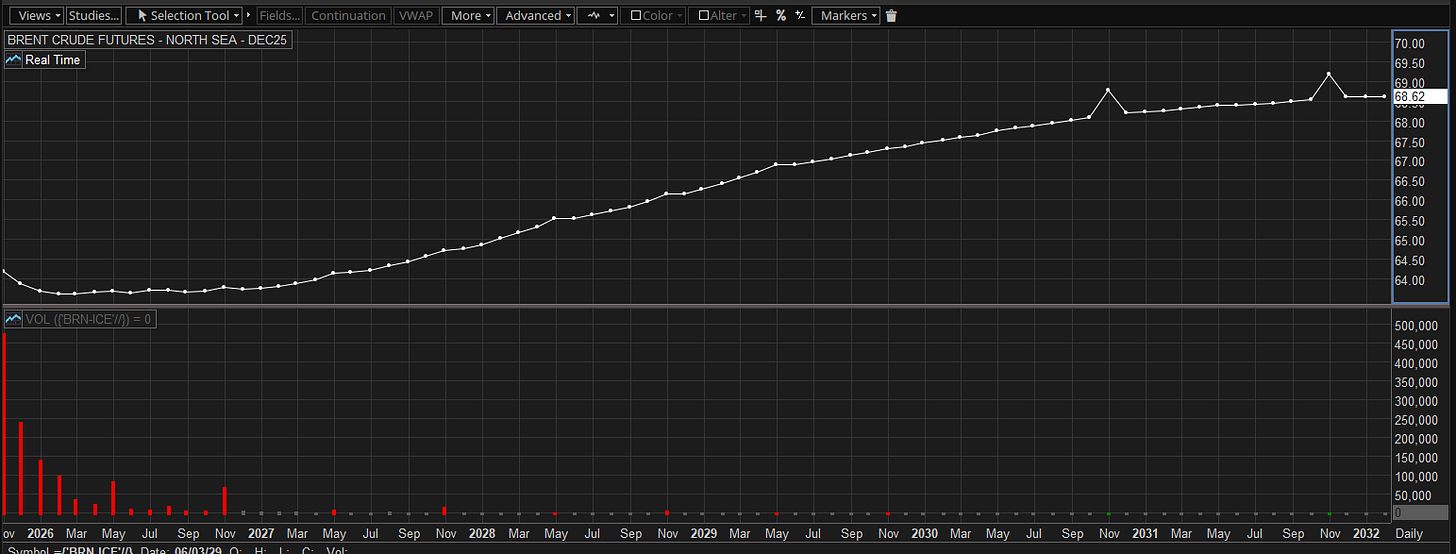

The oil market is flashing a warning the world hasn’t seen in years. In 2025, the familiar drumbeat of geopolitical risk and OPEC headlines has lost its power to hold prices buoyant. Futures contracts—the core instruments oil traders use to bet on tomorrow—now tell a radically different story: the era of healthy backwardation is ending, and contango is on the horizon. This is a sea change not just for energy markets, but for anyone investing in or depending on the global economy.

Understanding the Shift: From Backwardation to Contango

For years, oil’s futures curve was steeply backwardated. In plain language, this means the price for oil delivered today was higher than for oil delivered months from now. This scenario incentivizes immediate sale and discourages storage: buyers want oil now, not later. It’s the mark of a tight market—one where demand is strong and supply risks abound.

But contango is the opposite. When futures prices for later delivery rise above spot prices, it signals a world awash in oil no one needs immediately. This flip is more than a technicality; it’s a prophecy of oversupply and faltering demand.

In 2025, the backwardation trend is eroding fast. The difference between near-term and future prices has flattened to levels not seen since early 2023.

Since mid-August, spreads have narrowed dramatically—from over $2 to less than $1, bouncing weakly but remaining fragile.

By early October, some contracts are within 40 cents of true contango, meaning a storage glut is now assumed imminent.

This flattening is a warning shot across not just energy but all industrial markets. The market is beginning to price in a historic surplus—a situation most recently compared to the brief but brutal collapse of 2020 during the pandemic.

I have written previously about the market signals that Contango and Backwardation are giving us here :

Crack Spreads and Wholesale Gasoline: Demand Problems

Crack spreads—the margin refiners earn converting Brent oil into products like gasoline and diesel—have also fallen to multi-year lows. This is a direct indicator that even falling crude prices aren’t stimulating enough end-user demand.