Hedging Without the Headache

Asymmetric Payoffs in Panamax & Supramax

The shipping market doesn’t reward certainty—it punishes inflexibility. A Panamax time-charter equivalent (TCE) that you expect at $14,000/day can collapse to $8,000/day or surge to $22,000/day within a single quarter.

For shipowners betting their balance sheet on vessel employment, this volatility creates a strategic dilemma: do you lock in rates and accept opportunity cost, or pay for insurance and keep your upside?

This is the core trade-off between Forward Freight Agreements (FFAs) and freight options. Both settle against the same monthly-averaged underlying (Asian-style settlement, as discussed in my previous article on Asian options). Both can be closed out before expiry. Both use identical Baltic Exchange time-charter basket indices (Panamax 5TC, Supramax 11TC).

But their payoff structures are fundamentally different:

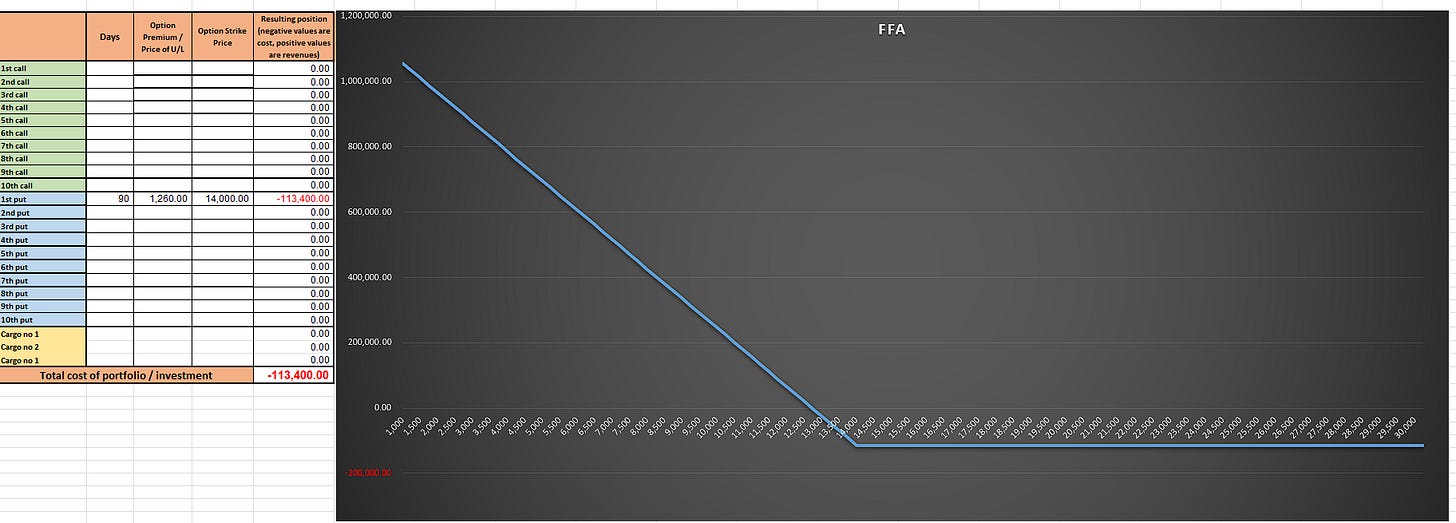

FFAs offer linear payoffs: Dollar-for-dollar gains when you’re right, dollar-for-dollar losses when you’re wrong. Zero premium, perfect budget certainty, but you surrender upside if markets move favourably.

Options offer asymmetric payoffs: Capped downside (limited to premium paid), unlimited upside participation. Known insurance cost, but you preserve optionality.